BAS Preparation

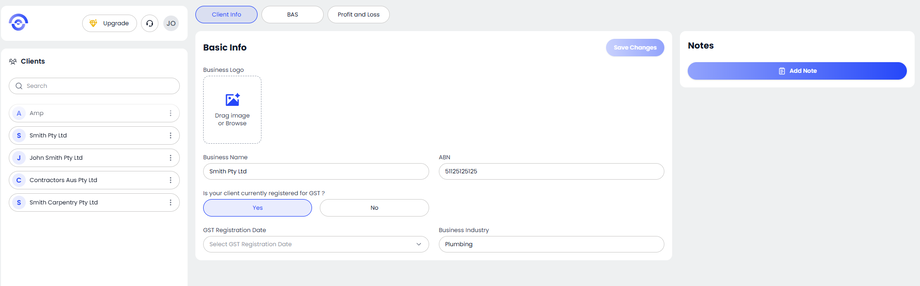

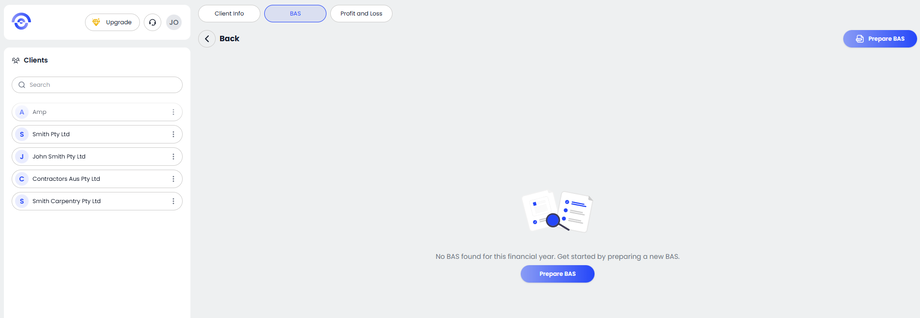

Step 1: Initiate the BAS Wizard

To begin, select your client from the sidebar and navigate to the BAS tab located in the top navigation bar. If no records exist, click the Prepare BAS button in the center of the screen or the top-right corner to launch the guided setup.

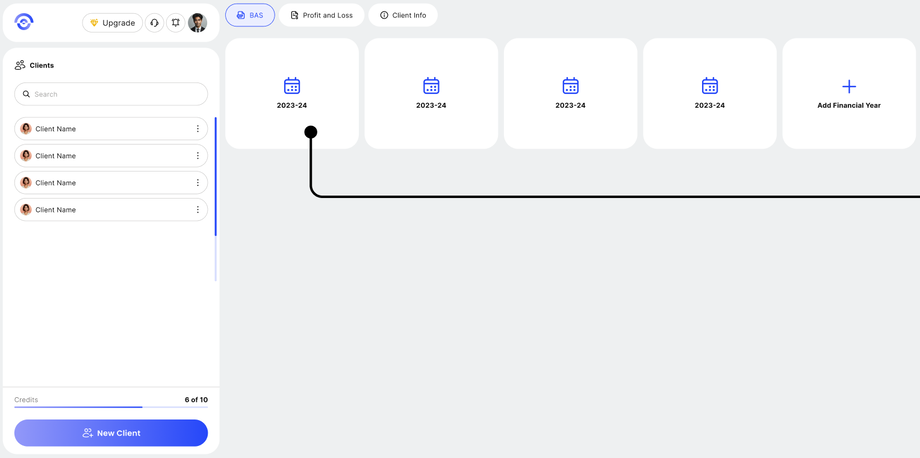

Step 2: Establish the Financial Year

If this is a new reporting cycle, you will be prompted to add a financial year container. Click the + Add Financial Year tile. In the "Add Year" modal, enter the relevant year (e.g., 2025-2026) and click Add. This ensures your data is correctly archived and aligned with Australian taxation standards.

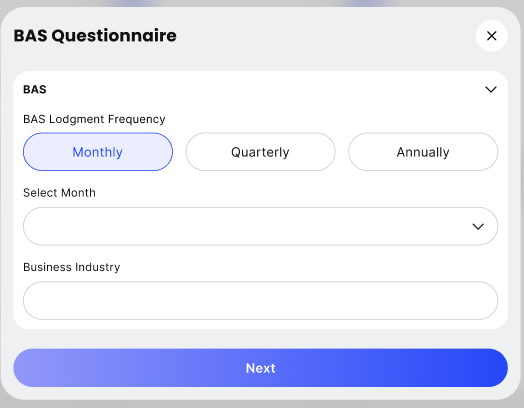

Step 3: Configure Reporting Frequency

Complete the BAS Questionnaire to define how Ezyiah should process your data.

Lodgment Frequency: Select Monthly, Quarterly, or Annually based on the client's ATO requirements.

Select Period: Use the dropdown menu to choose the specific month or quarter you are currently reconciling.

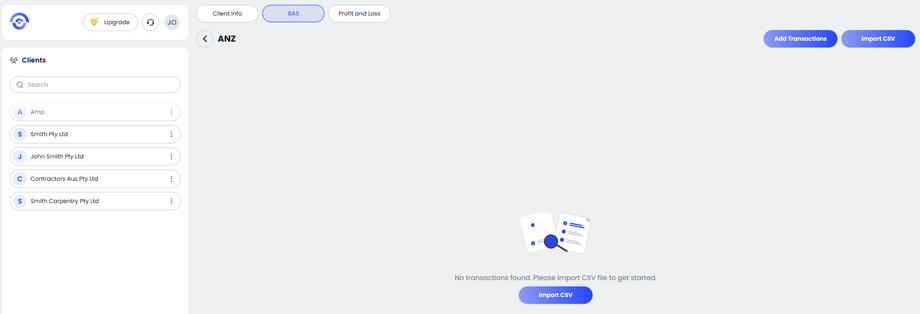

Step 4: Import Transaction Data

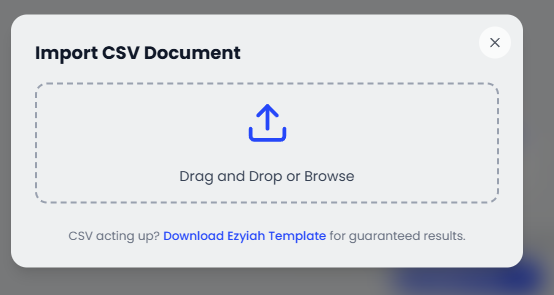

Once your reporting period is set, you can provide your transaction data. You have two convenient options in the Document upload portal:

Direct Upload: Simply drag and drop your bank's raw CSV file into the upload zone.

Use a Template: If you prefer, you can download our standardized CSV template from the provided link, fill in your transactions manually, and then upload it.

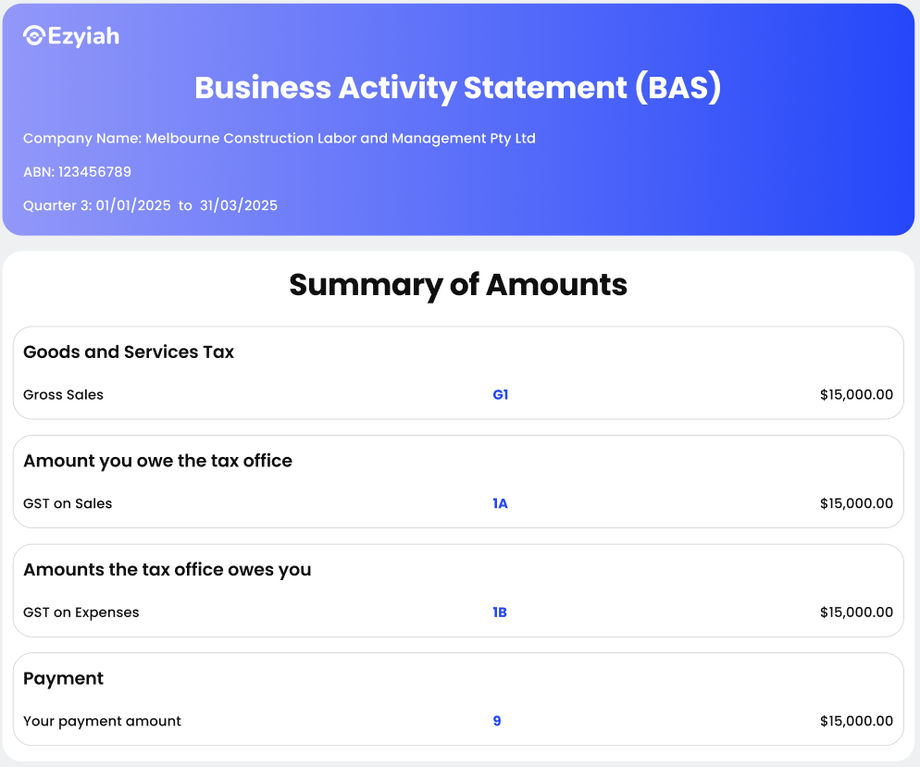

Step 5: Review Summary & Audit Trail

After the AI processes your data, you will be presented with a Summary of Amounts. This provides a clear breakdown of:

G1: Total Gross Sales.

1A & 1B: GST on Sales vs. GST on Expenses.

9: Your final payment or refund amount.

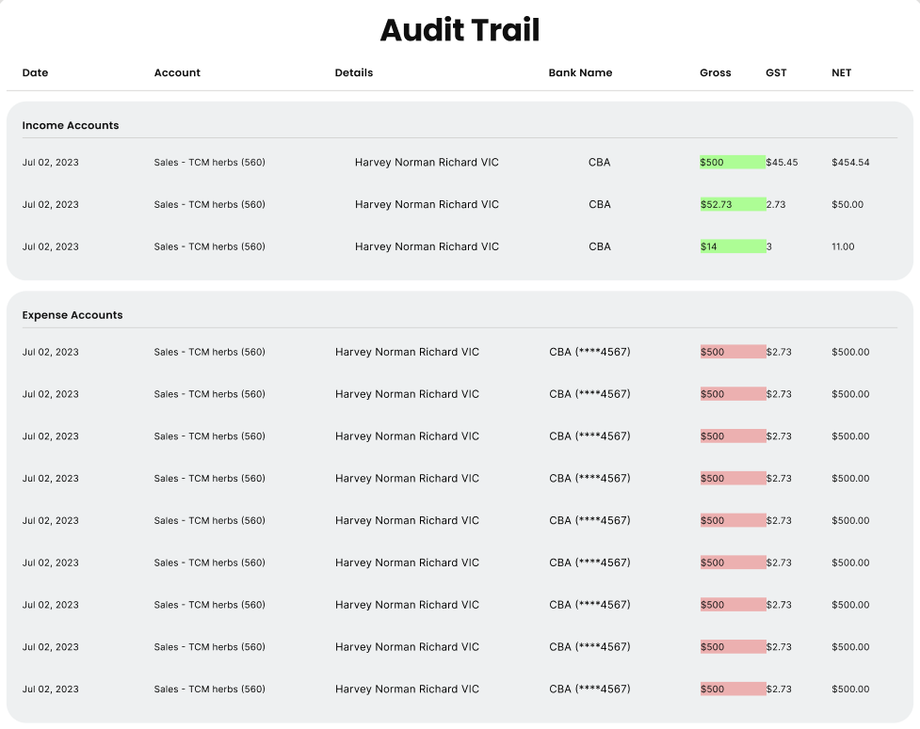

Review the Audit Trail below the summary to verify individual line items before clicking Download to export your final, branded report.